Is it worth paying a mortgage broker?

If you’re buying a home, refinancing, or investing in property, one of the most common questions people ask is: Is it actually worth using a mortgage broker?

With so much information online and direct bank offers everywhere, it’s a fair question. Let’s break it down so you can decide what makes sense for you.

Do you pay a mortgage broker?

In most cases, you don’t pay a mortgage broker directly, it is a free service to you.

Mortgage brokers are typically paid a commission by the lender you choose, not by you. This is generally built into the loan pricing, meaning you usually pay the same interest rate, fees and charges whether you go directly to a bank or use a broker.

That said, transparency matters. A good broker will clearly explain how they’re paid and ensure the recommendation is based on your needs, not theirs.

What does a mortgage broker actually do?

A mortgage broker does much more than compare interest rates.

They:

Assess your full financial position, income, expenses, and goals

Compare loans across multiple lenders, not just one bank

Structure your loan correctly from the start

Explain complex lending rules in plain English

Help prepare and lodge your application

Manage the process through to settlement

Continue supporting you with reviews and refinancing over time

For many buyers, especially first home buyers or self-employed borrowers, this guidance can be just as valuable as the loan itself.

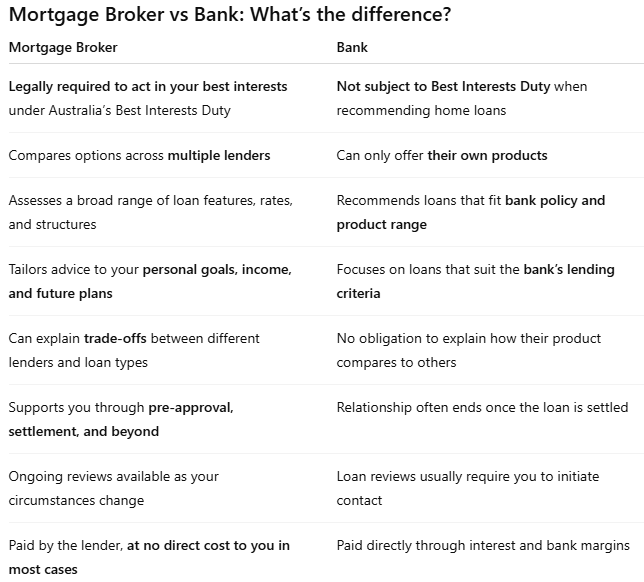

Broker vs going direct to a bank

When you go directly to a bank, you’re limited to that bank’s products and policies.

A mortgage broker can:

Compare options across dozens of lenders

Identify which lenders suit your circumstances best

Help you avoid policies that could limit borrowing or flexibility

Navigate tighter lending rules and serviceability assessments

This can be particularly helpful in competitive markets or when lending rules change, as banks all assess applications differently.

Can a broker save you money?

Potentially, yes.

A well-structured loan can:

Reduce interest paid over time

Avoid unnecessary fees or lenders mortgage insurance (LMI)

Include features like offset accounts or redraw that save interest

Ensure the loan suits your long-term plans, not just today

Even small differences in loan structure or rate can add up to thousands of dollars over the life of a mortgage.

What about independence and trust?

This is where choosing the right broker matters.

A quality mortgage broker:

Acts in your best interests

Is transparent about lender relationships

Explains why a loan is recommended

Focuses on suitability, not just price

Best Interests Duty and why it matters

Under Australian law, mortgage brokers are required to comply with the Best Interests Duty, which means they must act in the best interests of their client when recommending a home loan. This is a legal obligation, and brokers can face serious consequences if they fail to meet this standard.

Banks, on the other hand, are only able to offer their own products and are not required to compare options across the wider market. Their role is to recommend products available within their institution, rather than assess what may be best across multiple lenders.

This distinction is one of the key reasons many borrowers choose to work with a mortgage broker, particularly when they want advice that considers a broader range of options and long-term outcomes.

When a mortgage broker is especially worth it

Using a broker can be particularly valuable if you:

Are a first home buyer

Are self-employed or have variable income

Want to refinance but aren’t sure where to start

Are buying an investment property

Want a long-term lending strategy, not just a loan

For buyers in Wollongong and the Illawarra, local knowledge also matters. Understanding regional pricing, borrowing limits, and lender appetite can make the process smoother.

So, is it worth it?

For many people, yes.

A mortgage broker can save you time, reduce stress, help you avoid costly mistakes, and ensure your loan actually supports your financial goals.

The key is working with a broker who prioritises education, transparency, and long-term relationships, not quick wins.

Thinking about your next move?

If you’re weighing up whether to use a mortgage broker or want clarity around your options, a conversation can help.

At Haus of Loans, we take the time to understand your goals and explain your options clearly, so you can move forward with confidence.

Get in touch if you’d like to chat about your situation and see whether working with a mortgage broker makes sense for you.