November 2025 Property Market Update - Wollongong & Illawarra

We’re now heading into the final stretch of a busy spring selling season, and it’s been a standout one, particularly for sellers. Property prices have climbed sharply across the country, housing stock remains thin, and demand from buyers is still incredibly strong.

Here in Wollongong and the Illawarra, the trend has been much the same, with low listings and rising competition pushing prices higher as we approach summer.

This month, the Reserve Bank of Australia (RBA) kept the cash rate on hold after hotter than expected inflation figures. While another rate cut before Christmas is unlikely, buyers still have good momentum behind them. With three rate cuts already delivered in February, May and August, lenders are competing hard for new clients and that means opportunity if you’re planning a purchase.

If you’re hoping to secure your first home, next home or an investment property before year’s end, now’s the time to get your finance pre-approval sorted.

Interest rate news

The RBA has kept the cash rate steady at 3.60%, holding firm as inflation edges higher.

Key data for the September quarter shows:

CPI up 3.2% over the year

Housing costs up 2.5%

Recreation and culture up 1.9%

Transport up 1.2%

The trimmed mean the RBA’s preferred measure of underlying inflation rose to 3%, at the top of the target band and increasing for the first time since late 2022.

RBA Governor Michele Bullock acknowledged borrower frustration but emphasised the need to keep inflation under control:

“I know mortgage holders always want more, but it’s important that we keep inflation under control because that’s what protects living standards.”

Some economists are even signalling the next RBA move could be up, not down.

If it’s been a while since you’ve reviewed your home loan, now is a smart time to organise a home loan health check. With strong competition among lenders, better loan options may be available.

The next RBA announcement is scheduled for 9 December.

Home value movements

Property values continued to surge in October, with national dwelling prices rising 1.1%, the strongest monthly gain since June 2023.

Insights from Cotality show:

Every capital city recorded growth

Perth led with a 1.9% jump

Hobart had the softest rise at 0.4%

Regional markets also lifted 1%, the highest since early 2022

Cotality research director Tim Lawless noted that the February rate cut was the major turning point:

“Before February, conditions were deteriorating. Since the first rate cut, home values have moved into a strong positive upswing.”

The lack of advertised stock is also fuelling price growth. Listings remain 18% below average, intensifying competition.

The expanded Australian Government 5% Deposit Scheme has added significant demand from first-home buyers, particularly in the lower to middle price brackets.

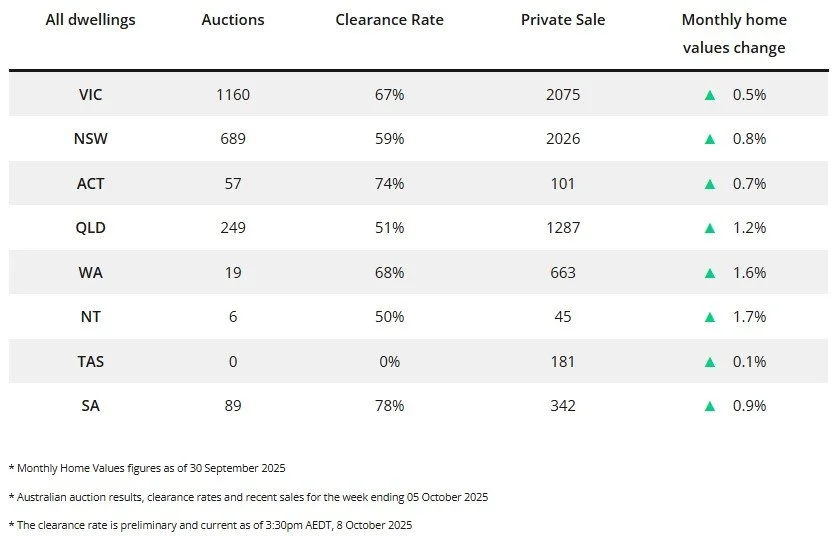

State-by-state snapshot

Ready to buy?

If you’re hoping to secure a property before summer, get in early so we can organise your finance pre-approval with confidence.

First-home buyers may also want to explore the Australian Government’s 5% Deposit Scheme, which now offers:

No cap on places

No income caps

Higher property price limits

No LMI when buying with a 5% deposit

We’ll step you through eligibility and help you understand how the scheme could reduce your upfront costs.

Get in touch today and let’s map out your next move.