October 2025 Property Market Update - Wollongong & Illawarra

Spring is in full bloom and so is the property market. The gardens are greener, the days are longer, and buyer confidence is high across Wollongong and the Illawarra.

The Reserve Bank of Australia (RBA) left the cash rate on hold at 3.60 per cent this month, but property values continue to trend upward nationwide. Every capital city recorded price growth in September, reflecting the momentum of the spring selling season.

Population & migration trends

Population growth remains a key driver of housing demand. While Australia’s overall population growth has eased since late 2023 due to stabilising overseas migration and lower natural increase, it still sits above the long-term average.

Migration within Australia is also returning to pre-pandemic norms. Fewer people are moving to Queensland and Western Australia, while Victoria is attracting more internal migrants, contributing to stronger activity in Melbourne and surrounding regions.

Across Wollongong and the broader Illawarra, demand remains solid, supported by employment hubs, lifestyle appeal and proximity to Sydney.

Interest rate news

At its October meeting, the RBA kept the cash rate steady at 3.60 per cent, following slightly higher-than-expected inflation data.

CPI: Up 3 per cent year-on-year to August (2.8 per cent in July)

Trimmed mean inflation: 2.6 per cent (August) vs 2.7 per cent (July)

RBA Governor Michele Bullock noted the Bank remains cautious:

“Market services and housing inflation were a little higher than we were expecting… it doesn’t suggest inflation is running away, but we just need to be a little bit cautious.”

If you haven’t reviewed your home loan recently, now is a good time for a home loan health check. We can compare lenders, assess your current rate, and help you decide whether refinancing could save you money.

The next RBA decision will be announced 4 November 2025.

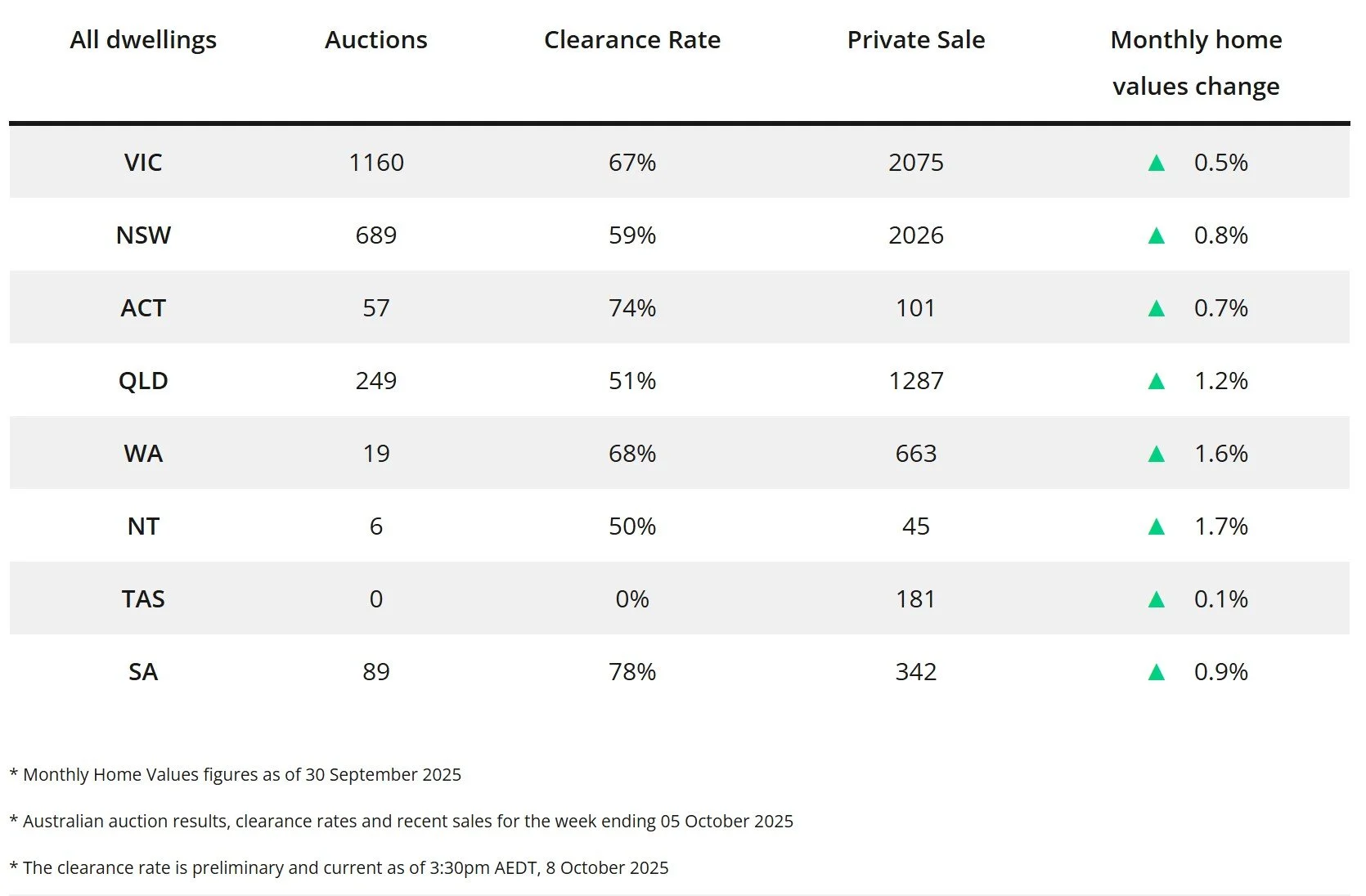

Home value movements

Property values rose across Australia through September, driven by record-low listings and surging demand.

According to Cotality, it was the strongest monthly rise in dwelling values since October 2023, led by Perth (+4 %) and Brisbane (+3.5 %) over the quarter.

“The number of homes for sale at the end of September was about 53 % below average in Darwin, 45 % in Perth and 31 % in Brisbane,” said Tim Lawless, Cotality’s Research Director. “Meanwhile, sales are above average — showing a clear disconnect between supply and demand.”

The recent expansion of the Home Guarantee Scheme (now branded the Australian Government 5 % Deposit Scheme) may add further upward pressure. The scheme enables eligible first-home buyers to purchase with just a 5 % deposit and no Lenders Mortgage Insurance (LMI) — and now features higher price caps (up to $1.5 million in Sydney) and no income limits.

Ready to buy this spring?

With limited stock and high competition, securing pre-approval before making an offer is essential.

At Haus of Loans, your local mortgage broker in Wollongong and the Illawarra, we’ll help you:

✅ Understand your borrowing capacity

✅ Compare 70+ lenders

✅ Arrange pre-approval so you can bid with confidence

Get in touch today to discuss your goals and let’s make your next property move happen.