Spring Market Update: September 2025

Spring is here, and with it comes one of the busiest times in the property market. Longer days, blooming gardens and renewed buyer confidence make this season a prime time for selling and competition is already heating up among buyers eager to secure their next home.

The latest cash rate cut has only added fuel to the market. In August, Australia’s median property price rose by 0.7%, the strongest monthly growth since May last year. With more rate cuts expected, this year’s spring selling season is shaping up to be full of opportunity for both buyers and sellers in Wollongong and the Illawarra.

If you’re thinking about buying, now is the time to get your finance pre-approved so you can move with confidence when the right property comes up.

Interest rate news

The monthly Consumer Price Index (CPI) rose 2.8% in the 12 months to July, up from 1.9% in June.

The Reserve Bank of Australia (RBA) responded by cutting the cash rate in August to 3.6%, while also signalling that two or three further cuts could follow.

All four major banks passed on the cut, giving borrowers meaningful relief. For example, on a $500,000 home loan, the savings amount to roughly $74 per month.

RBA governor Michele Bullock reinforced that the outlook is positive, with confidence inflation will remain within the target band without unemployment rising.

For borrowers, even small reductions can make a big difference over the life of a loan. It’s a good time to book a home loan health check and see how your current loan compares.

The next RBA cash rate decision will be announced on 30 September.

Home value movements

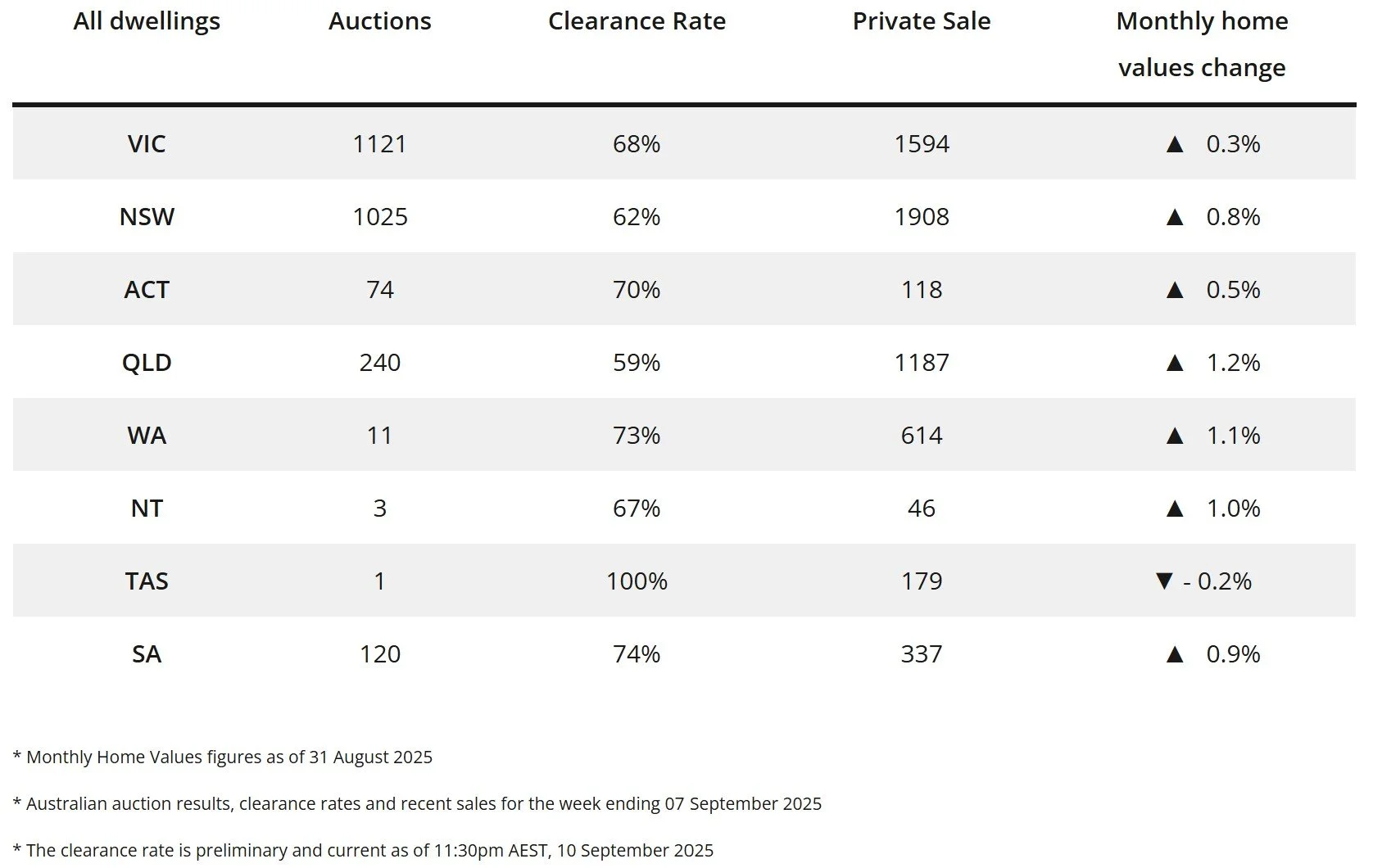

National property values rose by 0.7% in August, taking the median home value to $848,858.

Brisbane led with a 1.2% jump, followed by Perth (1.1%) and Darwin (1%). Adelaide (0.9%) and Sydney (0.8%) also saw solid growth, while Melbourne (0.3%) and Canberra (0.4%) crept higher. Hobart was the only capital to record a decline, down 0.2%.

Cotality head of research Eliza Owen said the drivers of rising home values were straightforward.

“You’ve got more demand in the housing market, with real wages growth up to its highest level in five years, lower interest rates and more consumer confidence aiding housing purchases,” Ms Owen said.

“You’ve got about 120,000 properties on the market for sale right now, whereas usually this time of year, the five-year average would be 150,000. “So rising demand against tight supply is continuing to see a rise in home values.”

Ready to buy?

With fewer listings and stronger competition, this spring is shaping up as a seller’s market.

That makes it essential to have your finance in order before you start making offers. Pre-approval gives you the confidence to act quickly and shows sellers you’re serious.

If you’d like to be ready when the right property appears, get in touch today. As your trusted mortgage broker Wollongong, we’ll line you up with the right finance solution so you can buy with confidence.